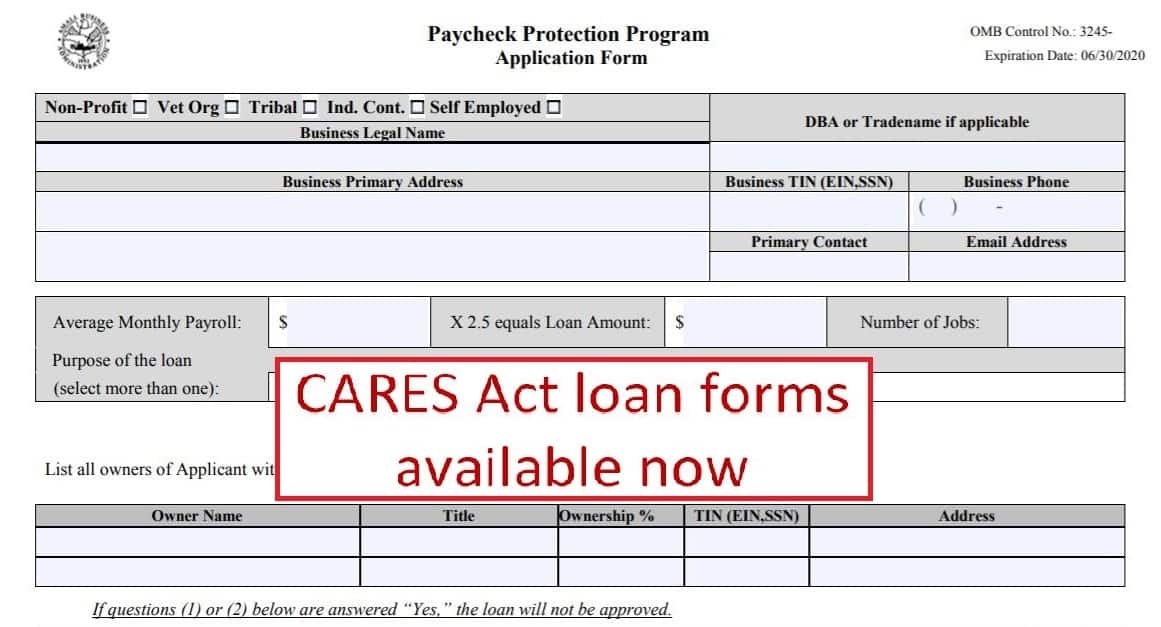

CARES Act loan forms

are now available

By Will Hall, Message Executive Editor

WASHINGTON (LBM)–The U.S. Department of the Treasury has released the form that must be completed when applying for a CARES Act Payroll Protection Loan through an approved Small Business Administration lender.

Churches and evangelists, as well as Christian schools and other ministry nonprofits, may access the application form using this link:

https://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Application-3-30-2020-v3.pdf

Otherwise, please visit this URL for the U.S. Treasury and click on the fourth link presented on the landing page to access the loan application:

https://home.treasury.gov/policy-issues/top-priorities/cares-act/assistance-for-small-businesses

LOAN ESSENTIALS

Basically, churches and other Christian ministries may receive a loan equal to 2.5 times the 12-month average of all salary costs. Essentially, this means each nonprofit will receive a loan equal to 2.5 months of payroll costs.

If the church maintains the same average number of employees through June 30, 2020, who were employed for either one of two periods (January 1, 2020, through February 29, 2020; or, February 15, 2019, through June 30, 2019), then the SBA will forgive 100 percent of the loan.

Church leaders should create a spreadsheet that totals all annual payroll costs per employee, not to exceed $100,000 per employee, from March 2019 through February 2020. Costs may include:

— salary

— group health care benefits

— paid sick, medical, or family leave

— insurance premiums

— commissions, or similar compensations

— telephone reimbursement

— travel reimbursement

— retirement

— housing allowance

Divide the total annual cost by 12 and then multiply this number by 2.5 to determine the qualifying loan amount.

Also, nonprofits can include requests that the loan also cover:

— payments of interest on any mortgage obligation (which shall not include any prepayment of or payment of principal on a mortgage obligation)

— rent (including rent under a lease agreement)

— utilities

— interest on any other debt obligations that were incurred before the covered period

Evangelists qualify for the payroll protection loans and the other provisions for nonprofits if they have set up a 501(c)(3) for their respective ministries. Otherwise they qualify at least for payroll protection loans as self-employed individuals, and may apply under the same terms and conditions of other self-employed applicants.