By Brian Blackwell, Baptist Message staff writer

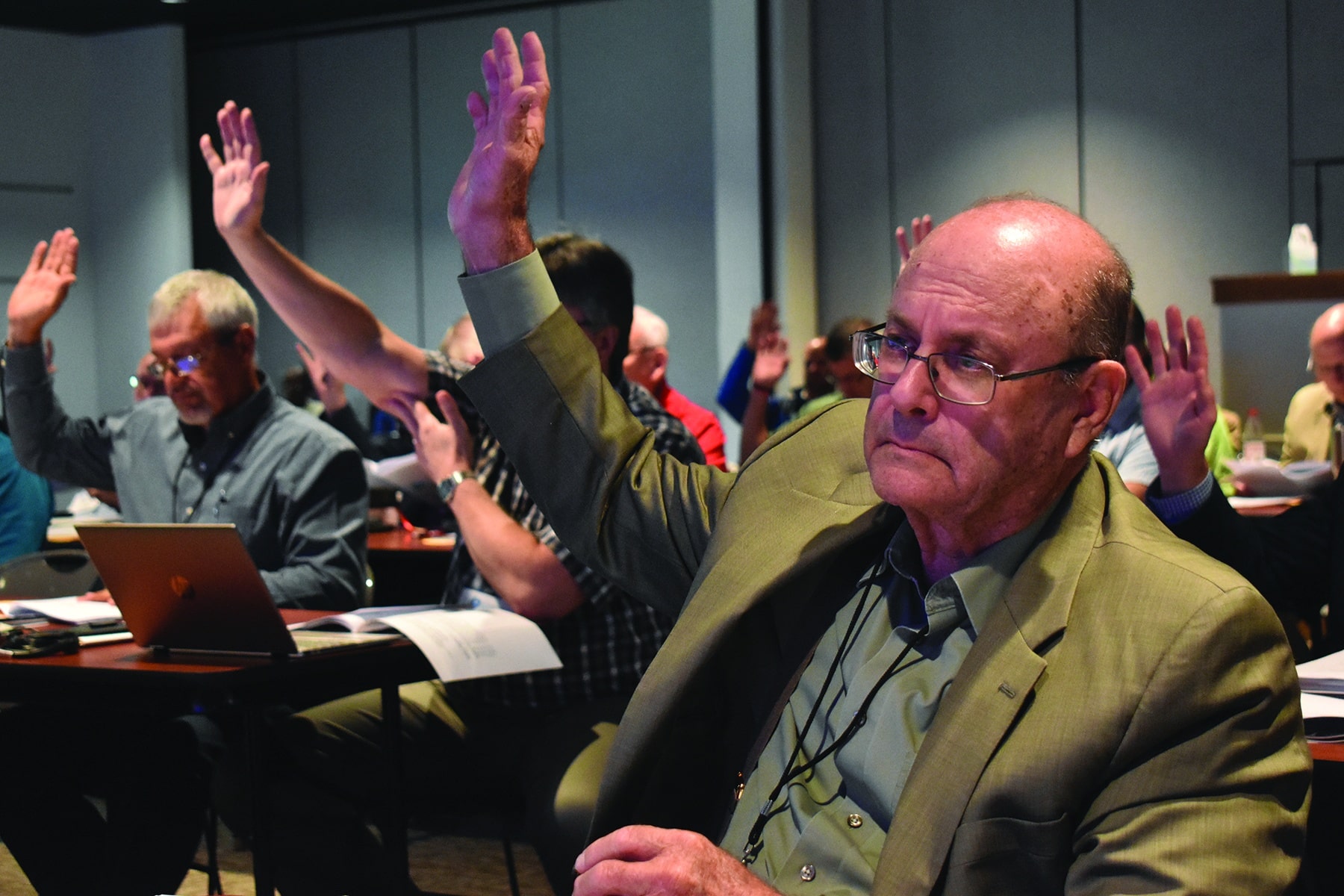

WOODWORTH, La. (LBM) – In response to the church insurance crisis that is pressing on congregations across the state, Louisiana Baptist Convention Executive Board members approved, during their Sept. 26 meeting, an advisory committee to help identify strategies and resources to secure one-time funding to launch the state legislature approved self-insurance program.

BACKGROUND

Louisiana lawmakers passed legislation in June, now signed into law by the governor, that established a church self-insurance trust.

However, a separate funding line item for the trust was deleted during negotiations between the Senate and House. Consequently, multiple approaches are underway to secure one-time funding from the state and federal governments and possibly other sources to assist with setup costs.

In the meantime, efforts are beginning to complete “no cost” steps while the funding appeals proceed.

The push to help churches began in March when Steve Horn, executive director of the Louisiana Baptist Convention, reached out to the Louisiana Baptist Office of Public Policy to share that churches were contacting his office about insurance nonrenewal notices and soaring premiums due to the four hurricanes of 2021-22.

Sen. Katrina Jackson responded to contact from the Louisiana Baptist Office of Public Policy by arranging a Zoom call with the state insurance commissioner.

Likewise, Sen. Robert Mills, a member of First Baptist Church, Bossier City, with Jackson as cosponsor, pushed through S.B. 147, which established the church self-insurance program.

MOVING FORWARD

Horn encouraged board members to contact him if they would like to serve on the advisory committee.

Additionally, he said an email and/or letter requesting historical insurance information from churches will be sent soon.

He said this is not an LBC program but rather a means to offer help to all the churches in the state, regardless of denomination.

“I dream of one day standing before you to tell you that there is a self-insurance program as an alternative for our churches to consider instead of traditional insurance which only promises at this point escalating premiums, higher than affordable deductibles, the very real possibility of churches not securing insurance, therefore leading to ultimately the inability to build back when, not if, the next hurricane comes,” Horn said. “I’m not willing to sit back and let that occur. So, we are at work for you and will not quit until there is a viable alternative.”