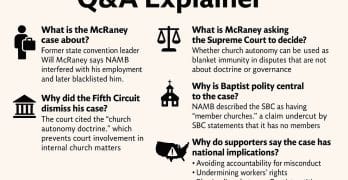

Excerpted from The Baptist Report: 'NAMB faces deep deficits, polity disputes as retirees lose promised benefits.' Polity Claims Challenged in Supreme Court Petition The financial concerns intersect with a broader legal battle now before the U.S. Supreme Court. Former state convention executive director Will McRaney has petitioned the Court to review a Fifth Circuit ruling that dismissed his claims against NAMB under an expanded interpretation of the “church autonomy doctrine.” McRaney alleges NAMB interfered with his employment at the Baptist Convention of Maryland/Delaware (BCMD) — an autonomous body — and later blacklisted him, harming his career. He argues the Fifth Circuit granted NAMB immunity even though he never worked for NAMB, never served as its minister, and never submitted to its authority. His petition contends the ruling contradicts Supreme Court precedent, which limits church‑autonomy protections to internal governance disputes. McRaney warns the Fifth Circuit’s expansion threatens the civil rights of ministers, Baptist bodies, mission agencies, and abuse survivors. The petition also highlights what McRaney calls intentional misrepresentations by NAMB and the SBC’s Ethics and Religious Liberty … [Read more...]

Worship and protests: Federal officials investigating protest at Minnesota church

FEDERALIST: SBC blew up its credibility to appease the #MeToo movement

VIDEO: Louisiana’s Cassidy & Murrill speak against mail order abortion drugs

VIDEO: ERLC’s Hollingsworth at SCOTUS hearing to protect women’s sports

TRANSCRIPT: US House Speaker, a Louisiana Baptist, urges SCOTUS to protect women’s sports

Adapted from a press release WASHINGTON — U.S. House Speaker Mike Johnson, a member of Cypress Baptist Church in Benton, Louisiana, delivered remarks on the steps of the U.S. Supreme Court during the Alliance Defending Freedom’s Protect Women’s Sports Rally, January 13, urging the Supreme Court to uphold common sense and basic truth, preserve the original meaning of Title IX, and protect the future of women’s athletics. TRANSCRIPT “Some things are just right, and some things are just wrong, and we have to stand and say that with conviction and clarity and consistency,” Johnson said. “I’ve got a couple of words for you this morning, I want to encourage you. Common sense is back to Congress. I want to thank the Alliance Defending Freedom for having the courage to stand and fight for women and girls all across this country. I know ADF well, I used to be one of their litigation attorneys. Sometimes I miss that work. “Listen, speaking of courageous individuals, we have a lot of brave women here. One of them is my attorney general from the state of Louisiana, Liz Murrill is here, and she's been one of the fighters. You'll hear from her in a moment. All of these folks are fierce advocates and defenders of women's sports … [Read more...]