Concerns mount as Syrian forces threaten Christians, Kurds

Iran deploys terrifying army of 1,000 drones

House Speaker Mike Johnson: God gives us a right to life

Lone Anglican church in Moscow suspends worship services

WMU’s board meeting underscores ‘meant for the mission’

By Julie Walters, WMU SBC communicaitons BIRMINGHAM, Ala. (WMU SBC) – Meant for the Mission, a two-year theme that will be woven throughout WMU curriculum beginning this fall, provided the backdrop for more than 20 different speakers who shared missions testimonies and illustrations of God’s faithfulness during WMU’s January board meeting, Jan. 10–12. Approximately 210 missions leaders from across the country gathered in Birmingham, Ala. where they participated in general sessions, 22 conference options designed to equip and inspire, interactive opportunities and more. “You, WMU, represent Southern Baptist’s higher standard of working together,” said Paul Chitwood, president of the International Mission Board, via video. “Indeed, it is through the influence of the WMU that, even as a young pastor, I consistently heard the church commit to being laborers together with God. And still to this day, it’s because of WMU’s commitment to the Great Commission and your commitment to work cooperatively as Southern Baptists on mission that we’re seeing lives changed together.” Todd Lafferty, executive vice president of the International Mission Board, said, “On behalf of the nearly 3,600 missionaries, along with their 2,900 … [Read more...]

Education Dept. joins fraud fight after $1 billion college student aid scheme uncovered

Fernando Mendoza, Indiana cap 16-0 season with CFP national title: ‘All glory and thanks to God’

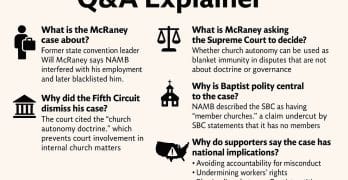

THE BAPTIST REPORT: Q & A Explainer (policy implications of McRaney v. NAMB)

Excerpted from The Baptist Report: 'NAMB faces deep deficits, polity disputes as retirees lose promised benefits.' Polity Claims Challenged in Supreme Court Petition The financial concerns intersect with a broader legal battle now before the U.S. Supreme Court. Former state convention executive director Will McRaney has petitioned the Court to review a Fifth Circuit ruling that dismissed his claims against NAMB under an expanded interpretation of the “church autonomy doctrine.” McRaney alleges NAMB interfered with his employment at the Baptist Convention of Maryland/Delaware (BCMD) — an autonomous body — and later blacklisted him, harming his career. He argues the Fifth Circuit granted NAMB immunity even though he never worked for NAMB, never served as its minister, and never submitted to its authority. His petition contends the ruling contradicts Supreme Court precedent, which limits church‑autonomy protections to internal governance disputes. McRaney warns the Fifth Circuit’s expansion threatens the civil rights of ministers, Baptist bodies, mission agencies, and abuse survivors. The petition also highlights what McRaney calls intentional misrepresentations by NAMB and the SBC’s Ethics and Religious Liberty … [Read more...]

Worship and protests: Federal officials investigating protest at Minnesota church

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 337

- Next Page »